Embracing the Future:

Modern Banking Solutions

at Your Fingertips

Multi-Banking

Map your existing current accounts to access & manage multiple account information including Transaction history and fetch account balances.

Virtual IDs

Simplify collections with unique Virtual IDs.

Smart Reconciliation

Businesses can easily access and view all their transactions

UPI Collection

Collect payments via dynamic, static QR Codes and Intent flows with real-time settlement.

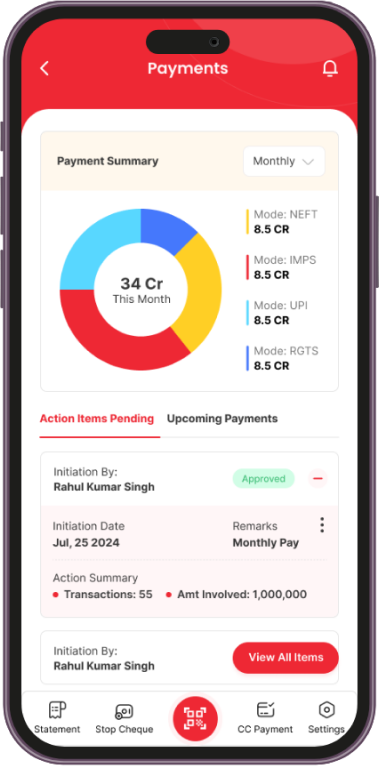

Payments

Ease your payouts to vendors, partners and employees into the payment mode of their choice.

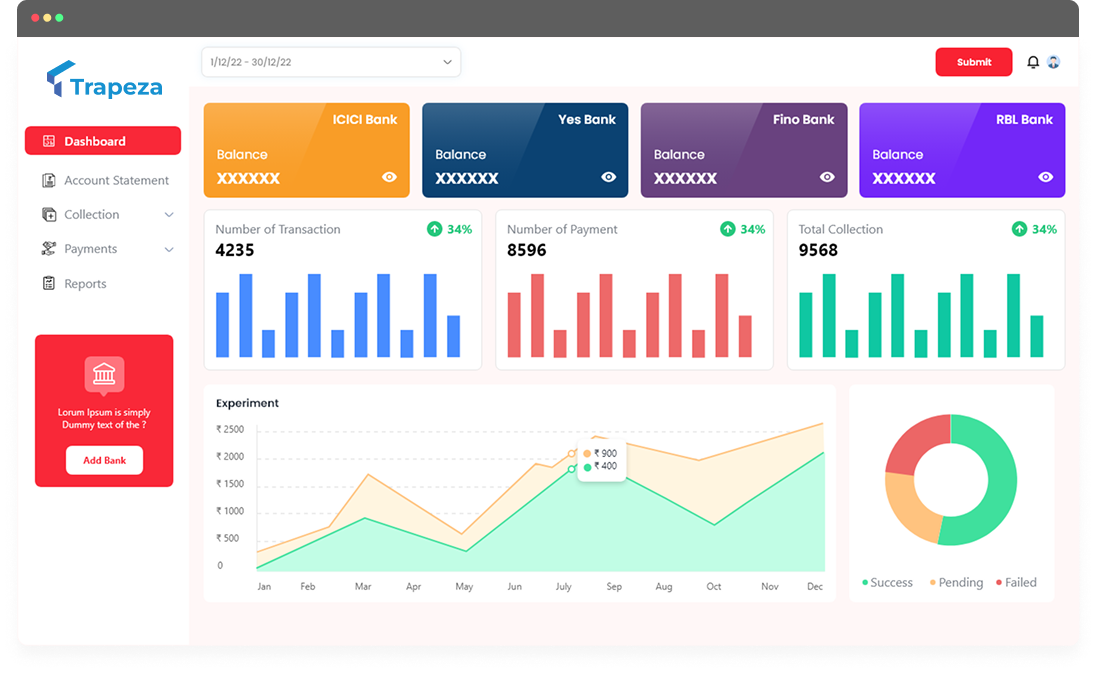

Multi-Purpose Dashboard

Explore the full potential of our robust analytical dashboard, designed to provide complete insight into managing all your financial transactions in one place.

Why Trapeza?

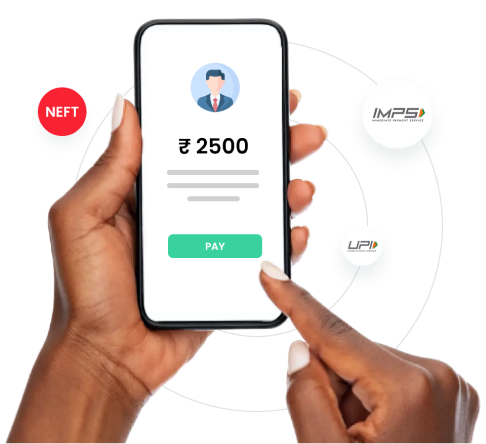

Multi-mode Payment Options

Now, you can seamlessly process payments using various methods, such as IMPS, NEFT, RTGS, and UPI, ensuring flexibility of options.

Real Time Insight

Gain immediate access to transactional data, providing valuable insights that improve cash flow management & support informed business decisions.

Collection Tracking & Reconciliation

Utilise our innovative APIs to track, find, & reconcile any transaction, enhancing accuracy and transparency in your financial operations.

Industries

Fueling Innovation Across Every Sector

E-commerce

Orchestrating efficiency in your e-commerce operations with fast, seamless payouts and effortless collections. Now reduce administrative burdens, and keep your online business running smoothly.

NBFC

Optimise your loan disbursements and EMI collections with our secure & automated solution. Enjoy timely transactions, reduced defaults, and improved customer satisfaction for your NBFC today!

Educational Institutions

Simplify your Fee Collections and Disbursements to ease your financial workflows with our smart payment solution to focus on what matters most – education.

Financial Services

Transform Your Collections experience & take your financial services to the next level with our automated recurring payouts. Offer a seamless, extensive financial solution that delights your customers and sets you apart.

Startup

Fuel your startup's growth with our agile payment solutions. Now is the time to simplify your accounting and transactions, with secure and scalable payment infrastructure.

Travel

Take your travel business to new heights with our seamless collections & payment solutions. Get your payment and booking processes simplified with us.

Insurance

Streamline insurance premium collections and payouts effortlessly with UPI-enabled QR codes and automated disbursements, ensuring faster and smoother financial operations.

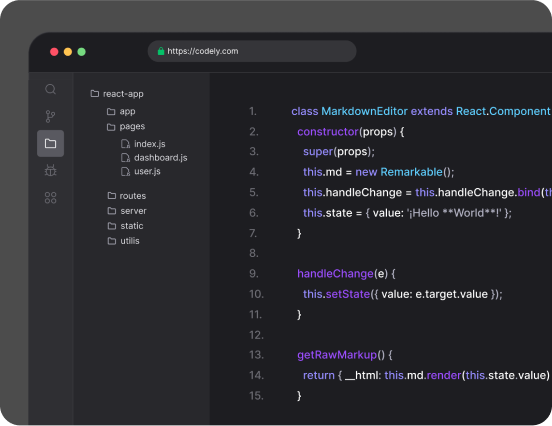

Code-Confident Platform Built

for ❮ Developers ❯

Integrations

Explore our integration stack, featuring popular platform SDKs, plugins, and server integrations, to connect with ease.

Developer's Hub

Get instant access to our comprehensive API reference, packed with resources to help you build robust payment solutions.

Easy Plug & Play Method

Stay informed with our webhooks, delivering instant notifications for payment-related transactions & events, so you're always in the know.

Frequently Asked Questions

Ready to Get Started?

Take the first step towards achieving your financial goals with Trapeza